Move In Fee vs Security Deposit: Your Questions Answered

As a landlord, it’s important to distinguish between a Move In Fee vs Security Deposit. Move-in fees are non-refundable charges covering costs like application processing, administrative tasks, and utility setup, helping you recoup initial expenses. In contrast, a security deposit is a refundable payment intended to cover potential damages, with any unused portion returned to the tenant after they move out. Understanding these differences helps you manage your property and set clear expectations with tenants.

On the other hand, a security deposit is a payment made by the tenant to protect against any potential damages or missed rent payments during the lease term (they get it back at move-out). The deposit is payable at the start of the rental agreement and typically amounts to one month’s rent, but can be more or less than that depending on state laws and specific landlord rules. Security deposits protect landlords by giving them money to repair damage caused by tenets beyond just wear and tear. They are then meant to go over the condition of the property, and if everything is in a good state then they give the renter their deposit back when he/she moves out.

Negotiating this financial soup is complicated enough without having to worry about legal issues. Every state has a different set of rules on how much landlords can charge as security deposits and the conditions under which those funds must be returned. Landlords must therefore make it a point to understand the laws where they live and comply with them, or risk trouble that can discredit their claims should anything go wrong in disputes and even legal responses.

This is still very important because being able to keep the move-in fees and security deposits organized, but where you win in this business of landlord ship is when it comes time for thorough tenant screening. One of the most important aspects of risk reductions when it comes to property investment is being able to bring tenants aboard that you can rely on. By using screening services landlords can learn a lot about someone’s past, by which they can check that the tenant in question is who they think it will be. With insight into the nuances of move-in fees and security deposits, including how to properly manage those funds in your operation — coupled with a laser focus on utilizing effective tenant screening methods — landlords can deliver seamless rental experiences which flow smoothly for all parties involved.

Decoding Move In Fee vs Security Deposit: What Sets Them Apart?

What is a Move-In Fee?

May 15, OLA commitment _ move-in fee The bill would allow landlords to charge tenants a non-refundable “move-in” or program fee expected before they could hand over the first month’s rent. This fee will be a standard amount that the landlord can attribute to their costs before tenants move into: ranging from administrative work, property management or setting up accounts for utility bills. A move-in fee, like rent or a security deposit, is highly variable depending on the location of your unit and likely based upon local rental market conditions in that area.

Application Fee

While most states that have such laws still allow landlords to charge rental applicants an application fee, the amount ranges from about $30 on up — sometimes past $100. This fee is mostly used to pay expenses for processing a credit check, background checks and personal references. – It reimburses landlords for the time and resources expended in vetting prospective tenants.

But be aware that some states regulate the amount which you can charge for application fees. For example, California limits the maximum screening fee to $35 The fee is only to be used for the exact out-of-pocket expenses incurred through the screening process plus a reasonable cost for time spent by the landlord obtaining…

- A consumer credit report

- Background information

- Personal references

Landlords in California that utilize the application charge to repay these costs must supply rental candidates with a detailed invoice. The most important thing is that it should be done in the clear and up to state law.

To remain compliant, landlords need to do a lot of research when setting their application fee structure and understanding both state-specific as well as federal laws. Using those data migration best practices can also help reduce friction:

- Notify applicants upfront that the fee is non-refundable unless the application is denied before the credit report is run.

- Clearly state the exact application fee amount on the rental application form to avoid any misunderstandings.

- Keep a signed copy of the completed application for your records to ensure that all documentation is properly maintained.

- Follow all local laws and regulations related to application fees to avoid potential legal issues.

This will occur often in competitive rental markets when you choose one applicant to rent your property while there are other applications and fees still pending. If you opt to not do the credit check on a prospective tenant, you must return their money quickly.

To make the application process more efficient, landlords should only charge for credit checks of potential tenants who pass some pre-qualification requirements (income verification). There is no set industry standard as the rule of lemme tends to dictate with rent-to-income ratios typically falling between 3 times the monthly rental amount — and can get much more ridiculous depending on location. If a candidate falls short of these screening criteria, chances are you should not be charging them the fee and just move on to your next applicant.

Receiving an application is one step, and then you move on to the legal and ethical considerations for receiving a credit report. A key takeaway here is that if you decide to deny an applicant based on their bad credit or offer them more expensive rent due to lower-tier credit history — all of those decisions are subject to the Fair Credit Reporting Act (FCRA).

If you are looking for an alternative to using a broker, there are several services available like My Credit Report Repair which is another company providing tenant screening that conforms with the FCRA regulations. You may charge the costs of your credit check to pass on to a tenant through an application fee, offering you alternate ways in which fees can be formulated that conform best with how you run things for business.

First and Last Month’s Rent

It is typical for landlords to ask that a tenant pay the first month of rent or prorated upfront. But some landlords also require you to pay your last month’s rent as part of the move-in costs, which affords them an extra measure of protection.

It seems logical enough that asking for the last month upfront is a safeguard. It stipulates that should you find yourself with a vacant property before the lease term expires by no fault of your own as the landlord (meaning not defaulting on rent), at least they will walk away/new tenants move in and pay off those remaining days so you’re still financially covered for it.

Pro Tip: If you decide to collect the last month’s rent with your move-in fee, this payment must be kept separate from the security deposit. The funds tracing should be marked out clearly, so ensure future clarity and assistance in handling them.

This model provides safety on your fund but is not very popular in short-term rental arrangements. What instead occurs in many cases is that landlords tack on a premium for month-to-month leases, typically from $100 to around$300 or some percentage over the general rent. This premium is because the longer leases tend to add price stability and long-term certainty for landlords, but the increased risk is associated with a potential turnover of tenant population in shorter-term leases.

By applying these strategies to your move-in process, you can attract new residents when it matters most: at key months where vacancy rates are highest (ensuring steady cash flow) and rely on them longer term to keep turnover costs low so that your rental business remains profitable and safe.

Pet Owner Fee

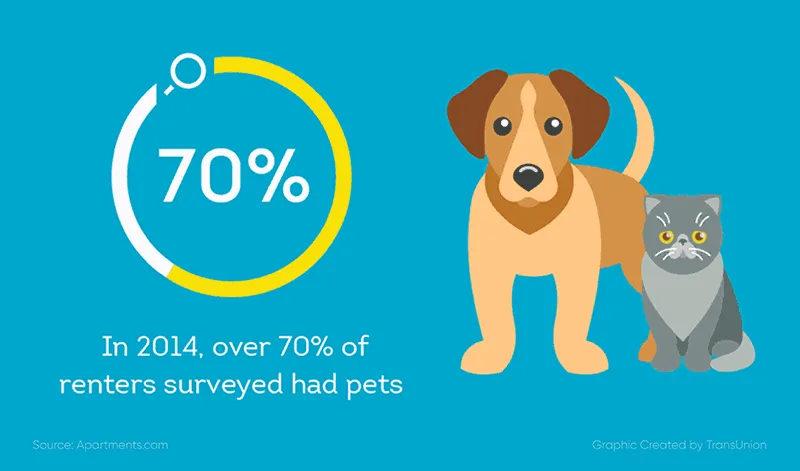

As the number of pet owners continues to rise, with over 75% of renters having pets according to Apartments.com, many landlords are opting to make their properties “pet-friendly” to attract a broader range of potential tenants.

Allowing pets in your rental property comes with its own set of advantages and challenges. Some of the benefits include:

- Increased rental income: Pet-friendly properties can command higher rents.

- Longer lease durations: Pet owners tend to stay in one place longer to avoid the hassle of finding another pet-friendly rental.

- Potentially more responsible tenants: Pet owners often display a sense of responsibility and care, not just for their pets but for the property as well.

If you change your mind and open up your property to pet owners, charging a move-in fee like this can be an excellent idea. Even the most obedient of pets is an additional source of wear and tear on property beyond what is normally expected. These added maintenance costs are included in your fee.

Pet owner fee: This should be modest, ideally within the $200 to $300 range per year. The type of pet should also dictate the amount charged. For example, a small bird or fish might not command the same fee as a large dog with multiple cats.

Pro Tip: you want to describe the pet fee as a “non-refundable deposit plus an additional charge for having and keeping pets” or something similar — get creative, but make sure it’s in your lease agreement under that Pet Policy section. Transparency around these factors helps prevent any disputes and keeps both sides informed on the same page.

Note: Not all states legally allow pet fees, so check your state-specific laws before including a pet fee in the lease. Making sure you are compliant can make the difference between having a valid policy and it being rejected when picked up by an attorney for its non-compliance.

Utility Connection Fee

Who Pays For Utilities In Your Rental Property Is A Big Thought Thing Paying for utility costs could help explain potentially inflated pricing and appeal to tenants who like all-inclusive payments — which is overwhelmingly the case with younger renters, as they want ease of use. However, handling utilities on your own is an additional task and oversight to keep up with.

The utilities you want to cover would usually depend on the type of rental property. In the case of multi-family units, apartment complexes or townhouses it could be argued that landlords should take care of paying for/utilizing some utilities such as:

- Water

- Trash

- Sewer

These are usually billed to the property as a whole, and landlords can either absorb the cost, charge tenants based on usage, or pass it directly through.

For single-family homes, tenants often set up and pay for utilities like:

- Gas

- Electric

- Internet

In some cases, landlords disconnect utilities during vacancies to reduce holding costs. Once a new tenant is secured, reconnecting services in your name can help expedite their move-in. However, any utility connection fees incurred can be included as part of the move-in fee.

Note: Landlords must ensure basic utilities like heat and water are available before a tenant moves in, as required by the implied warranty of habitability.

Association Dues

Homeowners Association If you are part of a Home Owners Association, it’s typical (likely also mandatory) that monies must be contributed each month toward the upkeep and maintenance cost for use by everyone. The fees in the case of single-family homes are such that it varies between $250 a month to as high as $350 per month — depending on what additional amenities they could offer for properties.

These costs can be charged to the tenant by you, their landlord, either as a separate charge or incorporated into the rent. Make sure that these dues are paid on time though as an HOA can cause some serious headaches including foreclosing the property.

Non-Refundable Deposit

In other cases, some landlords add a non-refundable reservation fee to the move-in amount This deposit usually amounts to about 2 weeks and is held against taking care of the property ready for the next tenant, say re-painting or changing locks/key issues. Since landlords are given the liberty to set this fee, it is important for them to walk that fine line between charging an amount high enough not just to cover expenses incurred but also to make note of revenue from renting out a property. A moderate fee is a balanced one that entices tenants but also maintains the property well-kept.

What is a Security Deposit?

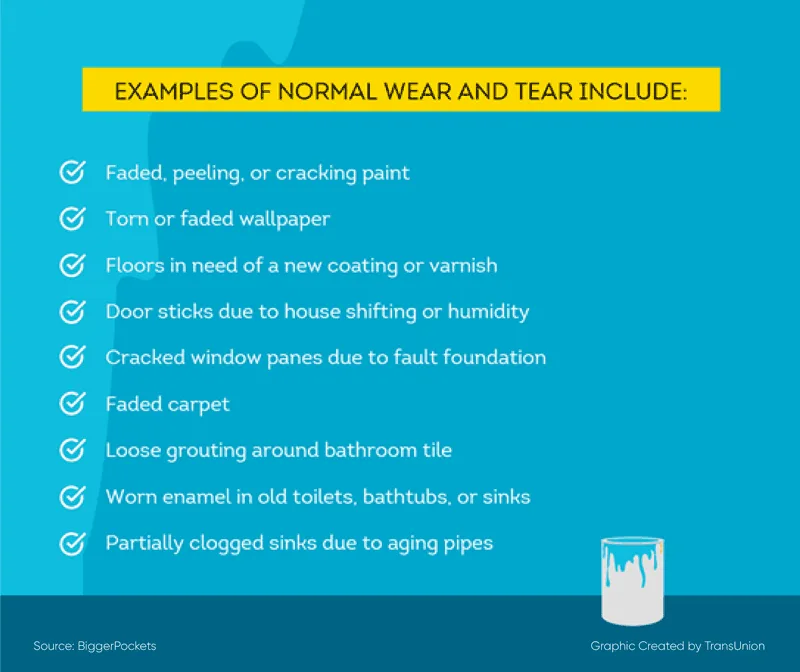

Your security deposit is a payment collected at the beginning of your lease that will cover any damages caused by you during your time living in the rental unit. A tenant must also receive any deposit that remains at the termination of a lease. When a tenant moves out, landlords can use security deposits to cover damages caused by tenants beyond normal wear and tear (usually scuffs or fading paint-related).

Landlords can prevent disputes by specifically defining normal wear and tear in the lease agreement, as well as presenting photos of the property before and after with dates. This way, it is transparent and both sides can come back if the argument of reason is to deduct some amount from your deposit.

Example Security Deposit Refund Form

To facilitate the return of a security deposit, landlords should provide a security deposit refund form that outlines the amount being returned and any deductions made. This form should include:

- Tenant Information: Name and forwarding address.

- Property Details: Address of the rental property.

- Deposit Amount: Total security deposit collected.

- Deductions: An itemized list of any deductions for repairs or cleaning.

- Refund Amount: Total amount being refunded.

Additionally, conducting a thorough walk-through with the tenant at the start of the lease using a move-in checklist can help document any pre-existing damage. This process protects both parties by ensuring that the tenant is not held responsible for damages they didn’t cause, and it allows the landlord to address any issues before they escalate.

How Much Can I Charge for a Security Deposit?

In most states, there are laws on how much landlords can charge for security deposits. In most states, deposits are limited to one- or two-month rent. Certain states may have different policies if the unit is furnished or unfurnished and for tenants depending on their age

There are about 20 states that have no statutory limit on security deposits, but it is important to keep the number modest. Exorbitantly priced rents will scare away potential tenants, and all those empty properties won’t help your bottom line one bit.

Pro Tip: Always research & comply with state and local rent regulations that may limit the maximum amount of security deposit you can collect Even LifeLock has faced expensive legal battles for overcharging or mismanaging refunds.

Keep in mind to abide by the Fund Storage state laws no matter how much you charge. Federal law states that security deposits may not be taxed as income because they might have to be refunded. Security deposits should generally be returned within 14-30 days after your lease ends.

Make sure you keep detailed records of all transactions involving security deposit money — not only does this help ensure you’re within the law, but may also be to your advantage when tax time comes around.

Note: Do check your state laws — some things might not able to be taken out of a security deposit! Other states, such as Wisconsin, ban the use of a security deposit for carpet cleaning. Allow yourself enough time to research completely and get legal advice before deducting any amount from a deposit.

Protect Your Investment with Proper Fees and Thorough Tenant Screening

Even when you implement fair move-in fees and security deposits, the cost of dealing with a damaging tenant soon afterwards is like living in financial hell. People who are lousy tenants frequently leave expensive repairs, which can be everything from horrible cleaning to real damages and a huge bill. Upfront fees and deposits often won’t cut it to cover the damages, so landlords are left chasing ex-tenants down on a bill.

The only way to manage this risk is by getting fantastic tenants from the get-go. Our tenant screening makes it easy for you to find a qualified renter that gives you the peace of mind needed before signing any new lease. Look for items that can potentially be red flags in an applicant’s history by doing criminal record checks and eviction reports.

Landlords who use My Credit Report Repair’s unique screening tools are better able to base their decisions on facts. For example, ResidentScore® is an applicant-credit score that was created specifically for the rental market to indicate if there is a risk of eviction based on data not shown on typical credit reports.

This proprietary analysis also includes an Income Insights™ report, giving you added visibility into a potential tenant’s ability to pay rent and reducing the risk of lost revenue.

Within minutes, you can complete a full applicant screening- Quickly Building Trust. Reports are sent immediately, using information from TransUnion—which is a trusted credit agency that has been around for over 40 years. Having access to critical insights enables you to approve a tenant on the spot, move-in ready and sign them up for their dream rental property that very day in some cases.