How to Improve My Credit Score by 200 Points: Proven Strategies

If you’re wondering, “how to improve my credit score by 200 points,” you’re not alone. Many people strive to significantly increase their credit scores, whether it’s to qualify for better interest rates, get a mortgage, or secure a car loan. A 200-point increase may sound daunting, but with dedication and the right strategies, it’s entirely achievable. This article will explore proven methods that can help you boost your credit score by 200 points, empowering you to take control of your financial future.

How to Improve My Credit Score by 200 Points: Setting a Realistic Goal

It may seem an overreach to increase your credit score by 200 points, but that’s the wrong attitude to take. The only way out of this mess is strategically. Consider first learning how factors affect whether or not someone has good credit history–factors like payment history; how much credit a person uses from lenders? and the length of one’s credit history The broader areas can all be worked on down in detail. Over time, a big improvement will gradually be realized this way. For a better understanding, refer to TransUnion Credit Score Range Explained: What’s a Good Score?. Over time, a big improvement will gradually be realized this way.

Your credit score is determined by a variety of factors, including:

- Payment History (35%): Whether you pay your bills on time.

- Credit Utilization (30%): How much of your available credit you’re using.

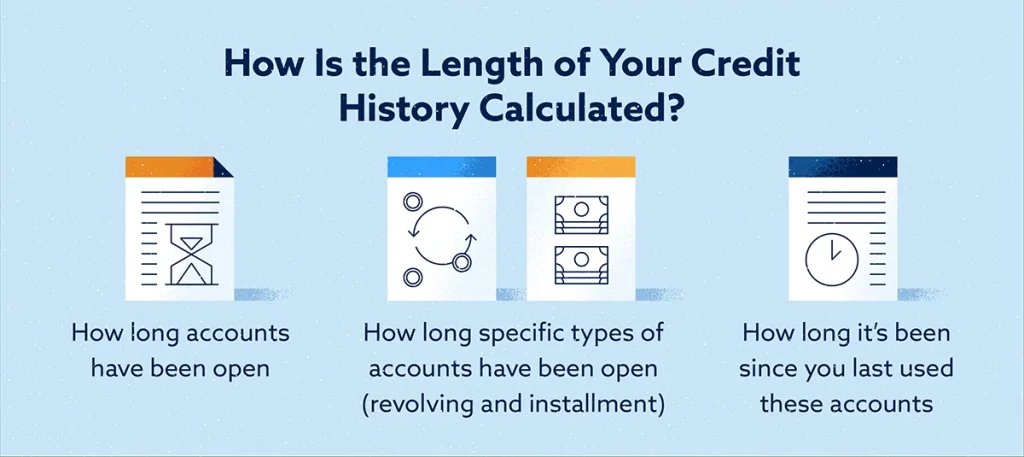

- Length of Credit History (15%): How long you’ve had credit accounts.

- New Credit (10%): Recent credit inquiries and accounts.

- Credit Mix (10%): The variety of credit accounts you have.

Now, let’s dive into some actionable steps you can take to see significant improvements.

1. Pay Down Credit Card Balances

Paying down your credit card balances is one of the most effective ways to raise your credit score. How much credit you’re using—a measure called credit utilization—accounts for 30% of your credit score. Learn why high utilization affects scores in Why Does Higher Credit Utilization Decrease Your Credit Score.

However, if you want to elevate your credit score by 200 points, you’ll need to go much further. A mere tenth, and no more.

Tips for Reducing Credit Card Balances:

- Focus on high-interest debts first: This not only helps improve your credit score but also saves you money on interest.

- Consider a balance transfer: Some cards offer 0% APR on balance transfers, which could help you pay down debt faster.

- Increase your credit limit: If paying off balances immediately isn’t possible, ask your credit card issuer for a higher limit. This reduces your credit utilization, but only if you avoid increasing your spending.

Here’s an image that shows how paying down credit card balances can positively affect your credit score:

2. Review and Dispute Credit Report Errors

A crucial preceding step to [improving your credit score improving your credit score] is to get copies of all your credit reports from each of the three major bureau outlets (TransUnion, Equifax, and Experian).It is amazing how many people have credit report errors and don’t even realized it. Some of these errors could well be erring against you in your score.

Having multiple accounts close together, reporting their payment status wrong and fraudulent transactions opened in your name can all lower your credit score. Often these errors can be fixed simply by contacting the credit bureau with your evidence.

How to Dispute Credit Report Errors:

- Obtain free copies of your credit reports: You can access your reports for free once a year at AnnualCreditReport.com.

- Identify errors: Look for inaccuracies such as incorrect balances, duplicate accounts, or accounts you don’t recognize.

- File a dispute: Contact the credit bureau reporting the error. Most bureaus allow you to file disputes online, by phone, or via mail.

This image shows a simple visual of how to dispute credit report errors:

3. Make Payments on Time

Your payment history is the most significant factor in determining your credit score, accounting for 35% of the overall score. Missing even a single payment can cause your score to drop, making it harder to improve by 200 points.

Check Fast Credit Repair in 30 Days: Proven Strategies for Quick Results for methods to quickly improve your score by establishing a strong payment history.

Tips for Ensuring On-Time Payments:

- Set up automatic payments: Many banks and credit card companies offer this option. You can automate at least the minimum payment to avoid missing due dates.

- Use payment reminders: Set reminders on your phone or calendar to ensure that you don’t miss any payments.

- Prioritize paying off high-impact accounts: If you’re struggling to pay all bills on time, focus on credit cards or loans first, as these have the most impact on your score.

Improving your payment history is one of the quickest ways to raise your credit score, especially if you’ve missed payments in the past. While it may take time to see the full impact, consistency will lead to progress.

Check out this image that emphasizes the importance of on-time payments:

4. Avoid Opening Too Many New Accounts

However, tempting might be to apply for new credit, and particularly when you get alluring incentives like 0% APR or rewards points, opening up too many new accounts in quick succession can in fact hurt your credit rating Score. New creditors check for account inquiries that did not exist before. These inquiries made up for 10% of the score. And each hard inquiry can send a few points to the dogs.

Instead, focus on keeping your existing accounts healthy and in good standing. Opening many new accounts in a short period can signal to lenders that you’re taking on more debt than is feasible, something that creditors will regard as unacceptable.

Strategies for Managing New Credit:

- Limit new applications: Only apply for new credit when absolutely necessary.

- Space out new credit inquiries: If you do need to apply for credit, try to space out your applications to avoid multiple hard inquiries in a short period.

- Consider a credit builder loan: If you’re looking to build credit without opening new lines of credit, a credit builder loan could help improve your score while minimizing risks.

This visual explains how opening too many accounts too quickly can hurt your credit:

5. Diversify Your Credit Mix

Another factor that influences your FICO score is the mix of credit types. Lenders like to see a body of credit that includes revolving and charging account (like credit cards) and installment loan types (such as mortgage loans, car leases, or student loans). Too much emphasis on one form of credit might lower the number assigned to your profile.

The more openly varied your credit mix, the more responsible you can legitimately claim to be in handling all kinds of credit. But wait! don’t rush into debt just for the sake of diversity. Be sure it fits your financial situation.

How to Diversify Your Credit Mix:

- Consider a secured credit card: If you have trouble qualifying for traditional credit cards, a secured card is a great way to build or diversify your credit profile.

- Look into installment loans: If you don’t already have an installment loan, such as a car loan or personal loan, adding one to your credit mix could help boost your score.

- Be cautious with store credit cards: While store cards can help diversify your credit mix, they often come with high interest rates and low credit limits, which can hurt your score if not managed carefully.

This image breaks down the components of a healthy credit mix:

Conclusion: Steady Progress Leads to a Better Credit Score

By keeping at it and using good financial strategies: You can surely improve your credit score by 200 points. Focusing on paying off debts, getting mistakes taken off your record, having current account payments posted in time or early for banks to see them making on-time payments, managing credit in a responsible way so that it looks good to new creditors, and having multiple types of credit can all help you rise up the credit ladder. No. These things take time to work out. With patience and discipline, however, you WILL see a marked improvement in financial health over these next seven years.

Whether you’re aiming for a better interest rate, a mortgage, or simply more financial freedom, follow these 9 steps to get closer to your goal. Get control of your credit today! Before long you’ll be enjoying the benefits of a higher score.