How to Get Transunion Credit Report PDF: Easy Steps

Accessing your Transunion credit report in PDF format is simple. It’s a vital step in managing your financial health.

Your credit report holds your financial story – from loans to credit cards. It’s essential to keep track of this document. It helps you understand your credit status and correct any errors. Let’s dive into How to Get Transunion Credit Report PDF.

Everyone should check their credit report regularly. It shows you where you stand when applying for loans or credit cards. This report can also alert you to any fraudulent activity in your name. In this guide, we’ll walk you through the steps to get your Transunion credit report in PDF. We’ll make it easy, even if you’re not familiar with financial jargon or processes. Our aim is to help you secure a copy of your report. It’s your right to access it, and we’ll show you how, free of any complexity or confusion.

Introduction To Transunion Credit Reports

Credit reports are essential for financial health. They show your credit history. Lenders use them to decide on loans. It’s vital to check yours often. TransUnion is a major credit bureau offering these reports. A PDF version of your TransUnion report can be downloaded. It’s simple and free once a year. This guide will show you how.

Importance Of Credit Reports

Credit reports affect your life. They impact loan approvals, interest rates, and more. A good report can mean better loan terms. It’s critical to know what’s in yours. Errors can be fixed to improve your score. Regular checks keep your financial reputation strong.

Transunion’s Role In Credit Reporting

TransUnion is one of three major credit bureaus. They collect and maintain credit information. This bureau helps lenders assess credit risk. Your TransUnion report contains personal and credit history. It includes account details and payment records. Knowing your TransUnion score is key to understanding your credit health.

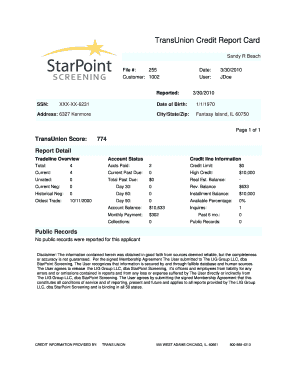

Credit: www.preemploymentscreen.com

Eligibility Criteria For Receiving A Transunion Report

Understanding your credit score is important. A TransUnion credit report can help. This report shows your credit history. It helps banks decide if they should lend you money. Want to get your TransUnion report? First, know if you can. Let’s talk about who can get this report.

Qualifying For A Free Annual Report

Everyone has the right to one free credit report every year. This rule applies to reports from all three big credit agencies, including TransUnion. You can get this report if:

- You ask for it.

- You have not gotten another free report in the last 12 months.

Getting your free report is easy. Go to the official website. Fill out a form. Then, you can view your report online.

When To Pay For Additional Reports

Sometimes, you may need more than one report in a year. Maybe you are checking for errors or fraud. Maybe you are applying for a loan and want to check your score first. In these cases, you can still get a report, but you might have to pay.

Prices for extra reports are not high. Still, it’s good to only buy them if you really need them.

Remember, knowing your credit score helps you make better money decisions. A TransUnion report is a good start. Check if you are eligible. Then, get your report. It’s your right.

Navigating The Transunion Website

Getting your TransUnion credit report is straightforward. Follow these steps to access your financial data.

Creating An Account

Start by setting up your profile. Click on ‘Sign Up’ and provide necessary details.

- Enter personal information

- Choose a secure password

- Set up security questions

Confirm your email to activate your account.

Finding The Credit Report Section

Once logged in, locate the ‘Credit Report’ tab.

- Navigate to the dashboard

- Select ‘Reports’ from the menu

- Click on ‘View Report’ to access your PDF

Download and save your report for future use.

Requesting Your Credit Report

Understanding your credit health is vital. A TransUnion credit report offers a snapshot of your credit history and score. Secure a PDF copy of your TransUnion credit report with ease. Follow these steps to request your credit report today.

Online Request Form

TransUnion makes it simple to request your credit report online. Their user-friendly platform is designed for quick access. Begin by navigating to the official TransUnion website. Look for the credit report request section. You will find an online form ready for submission.

- Locate the ‘Credit Report Request’ option

- Fill out the necessary details on the form

- Submit the form to proceed with your request

Information Required For Verification

To verify your identity, TransUnion requires specific information. This step ensures the security of your credit data. Prepare to provide your personal details accurately.

| Information Needed | Details to Include |

|---|---|

| Full Name | Your legal name, including any middle names |

| Date of Birth | The day, month, and year you were born |

| Social Security Number | The 9-digit number assigned to you |

| Address | Your current home address |

| A valid email for communication |

Complete all fields with accurate information. Double-check for typos or errors. Submit the form once all information is verified. A PDF copy of your TransUnion credit report will be on its way to you.

Understanding The Report Options

Getting your TransUnion credit report is an important step in managing your finances. This guide helps you understand your options for viewing this report.

Single Vs. Triple Bureau Reports

Single bureau reports come from one agency. In this case, TransUnion. Triple bureau reports include information from three main credit agencies. These are TransUnion, Experian, and Equifax.

- Single bureau report: Focuses on TransUnion data.

- Triple bureau report: Offers a wider view. Combines data from three sources.

Additional Features And Services

TransUnion offers more than just credit reports. They provide tools and services to help you manage your credit health.

| Feature | Description |

|---|---|

| Credit Monitoring | Keeps an eye on your credit report. Alerts you to changes. |

| Credit Lock | Lets you lock your credit. Prevents unauthorized access. |

| Score Simulator | Shows how your actions might change your score. |

These tools help you stay informed. They protect your credit health.

Accessing The Report Pdf

Getting a TransUnion credit report is straightforward. Follow these steps to access your credit information in a PDF format.

Downloading The Report

Visit TransUnion’s official site. Click on ‘Credit Reports’. Select ‘Request your Credit Report’. Follow the prompts. You’ll reach a page with a download link. Click it to get your report.

Check your downloads folder. Your TransUnion report should be there as a PDF. Save it in a secure place.

Ensuring Your Computer’s Compatibility

Before downloading, make sure your computer can open PDF files. Most computers have Adobe Reader. It’s free and opens PDFs. If you don’t have it, download and install it from Adobe’s website.

- Check for Adobe Reader on your computer.

- If missing, visit Adobe’s website.

- Click ‘Download Adobe Reader’.

- Install it after downloading.

Now you’re ready to view your credit report without any hiccups.

Checking Report Accuracy

Checking the accuracy of your TransUnion credit report is crucial. A mistake can affect your score. It’s important to review your report regularly. This ensures your financial health stays strong.

Identifying Errors

First, get your TransUnion credit report PDF. Look for mistakes. These can be wrong personal details or accounts that aren’t yours. Also, check for correct credit limits and loan amounts.

- Wrong names or addresses

- Accounts that are not yours

- Incorrect account statuses

- Wrong credit limits or loan amounts

Steps For Disputing Inaccuracies

To fix errors, you must dispute them with TransUnion. Here’s how:

- Gather evidence: Collect documents that prove the error. This can be bank statements or letters.

- File a dispute: Go to TransUnion’s website. Use their dispute process.

- Send your documents: Upload or mail your evidence to TransUnion.

- Wait for results: TransUnion will check your dispute. This can take up to 30 days. They will send you the results.

Disputing errors can improve your credit score. This makes loans and credit cards easier to get. Remember, checking your credit report often is key.

Maintaining A Good Credit Score

Understanding how to maintain a good credit score is crucial. A strong score helps secure loans at better rates. It reflects financial reliability to lenders. Let’s explore ways to keep your credit health at its peak.

Tips For Positive Credit Health

- Pay bills on time: Late payments hurt scores.

- Keep balances low: High balances on cards can lower scores.

- Avoid opening many new accounts: This can look risky to lenders.

- Check credit reports regularly: Spot errors and fix them fast.

- Build a credit mix: Have a mix of credit types, if possible.

Frequency Of Credit Checks

Regular checks on your credit report keep you informed. Aim for at least once a year. TransUnion allows one free report annually. More frequent checks are fine, especially if you are planning big financial moves.

Additional Resources And Support

Understanding your credit report is crucial for financial health. TransUnion makes it simple to access and understand your credit information. Below, find resources and support tailored to help you with your credit report.

Customer Service Assistance

Need help with your TransUnion credit report? Their customer service team is ready to assist. You can contact them through various channels. They offer support over the phone, email, and live chat. This ensures you get timely answers to your questions. Their team can guide you on how to obtain your credit report in PDF format. They can also help with any discrepancies you may find.

Educational Tools From Transunion

TransUnion doesn’t just provide credit reports. They also offer educational tools to help you understand credit. These tools include articles, videos, and calculators. They explain credit scores, reports, and how to improve your financial standing. By using these tools, you can make informed decisions about your credit.

- Interactive calculators estimate loan payments and debt payoff times.

- Informative videos break down complex credit concepts.

- Articles cover various topics like identity theft and credit repair.

Credit: www.transunion.com

Credit: www.pdffiller.com

Frequently Asked Questions

How Can I Download My Transunion Credit Report As A Pdf?

You can download your TransUnion credit report as a PDF by logging into your TransUnion account. Navigate to the credit report section, and look for a download or print option. Select PDF as the format and save it to your device.

Is Accessing My Transunion Credit Report Free?

Yes, you’re entitled to one free TransUnion credit report every 12 months through AnnualCreditReport. com. Outside of this, TransUnion may charge a fee for additional reports or through their monitoring service.

What Information Do I Need To Access My Transunion Report?

To access your TransUnion report, you’ll need to provide personal information such as your name, address, Social Security number, and date of birth. This ensures the security and privacy of your financial data.

Can I Dispute Errors On My Transunion Report Online?

Yes, you can dispute errors on your TransUnion credit report directly through their website. Log in to your account, navigate to the dispute section, and follow the instructions to submit a dispute.

Conclusion

Securing your TransUnion credit report PDF is straightforward. Follow the outlined steps for quick access. Remember, regularly checking your credit report is key to managing your financial health. It helps spot errors and keeps your credit history transparent. Stay informed about your credit score with ease.

Start today, and keep your financial future secure. Your credit, your control.