Can You Download Transunion Credit Report? Quick Guide!

Your credit report is key to understanding your financial standing and is crucial for making informed decisions. Can you download TransUnion credit report? Knowing how to access and interpret this document can empower you to take control of your credit score. A credit report is more than just a document; it’s a reflection of your financial journey.

It reveals your history of borrowing and repaying debts, making it indispensable when applying for loans or credit cards. The ability to download your TransUnion credit report means you have immediate access to your credit information. This report can help you spot any inaccuracies or potential fraud, ensuring that your credit profile is an accurate representation of your financial behavior. By reviewing your credit report regularly, you can also gain insights into what factors may be affecting your credit score, giving you the opportunity to improve it. With a few simple steps, you can download your TransUnion credit report, maintain a vigilant eye on your financial health, and position yourself better for future financial opportunities.

Credit: www.transunion.com

Introduction To Credit Reports

Credit reports are vital to financial health. They contain your credit history, including loans, credit cards, and payment records. Lenders use these reports to decide on giving loans or credit. Understanding your credit report can help you improve your credit score.

Importance Of Credit Monitoring

Regular credit monitoring keeps you aware of your financial standing. It alerts you to any errors or fraudulent activity. This can protect you from identity theft. Staying on top of your credit can also help you spot trends and track progress as you work to improve your credit score.

Transunion’s Role In Credit Reporting

TransUnion is one of the three major credit bureaus. It gathers and maintains data on over one billion consumers globally. Their reports influence credit decisions. With TransUnion, you can access and review your credit report. This allows you to ensure your financial data is accurate and up-to-date.

Eligibility For Downloading Transunion Reports

Understanding your credit is vital. You might wonder, can you download your TransUnion credit report? Yes, you can. But, who can do this? Let’s dive into the eligibility for downloading TransUnion reports.

Criteria For Access

To download a TransUnion credit report, you must meet certain criteria. First, you need an identity proof. This could be a passport, driver’s license, or state ID. Second, you must have a Social Security Number (SSN). Lastly, you should answer some questions to verify your identity.

- Identity proof – Passport, Driver’s license, State ID

- SSN – Social Security Number is required

- Verification questions – To confirm it’s really you

Frequency Of Access

You can download your TransUnion report once a year for free. This is thanks to the Fair Credit Reporting Act (FCRA). You may want more updates. Then, you can sign up for TransUnion’s credit monitoring service. This service offers more frequent reports. But, it might cost money.

| Access Type | Frequency | Cost |

|---|---|---|

| Annual Credit Report | Once a year | Free |

| Credit Monitoring Service | More often | Paid |

Remember, checking your credit report is key. It helps you catch errors. It also shows you where you stand credit-wise. Ready to check your report? Make sure you meet the criteria and decide how often you need access.

Steps To Access Your Transunion Report

Keeping track of your credit is vital. Your TransUnion report has this key info. Let’s get it.

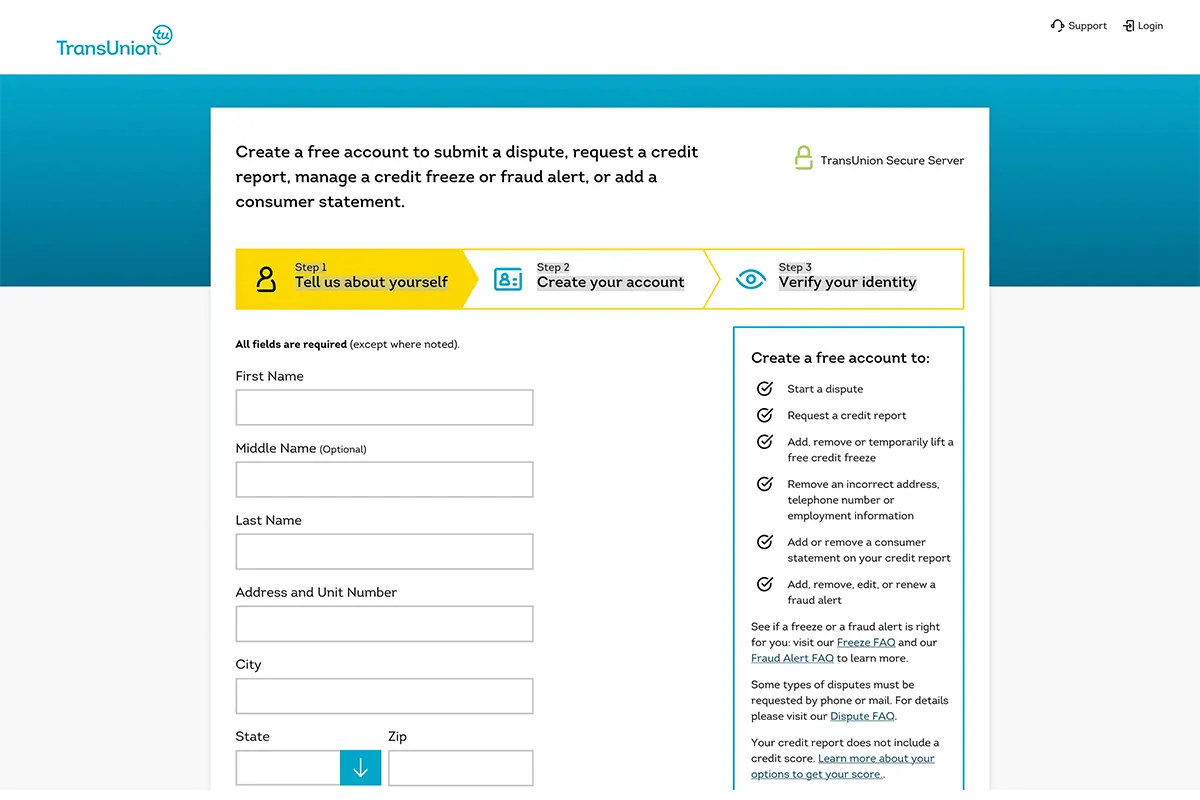

First, visit the TransUnion website. Look for the ‘Create Account’ button. Click it.

Fill in your personal details. Use your real name, address, and email. Choose a password.

TransUnion ensures your identity is real. They ask questions only you know. This keeps your info safe.

Answer with care. Mistakes can lock you out. If you get stuck, customer support can help.

- Enter your social security number. It’s needed for your report.

- Answer personal questions. They may be about past addresses or accounts.

- Complete the process. Now you can access your credit report.

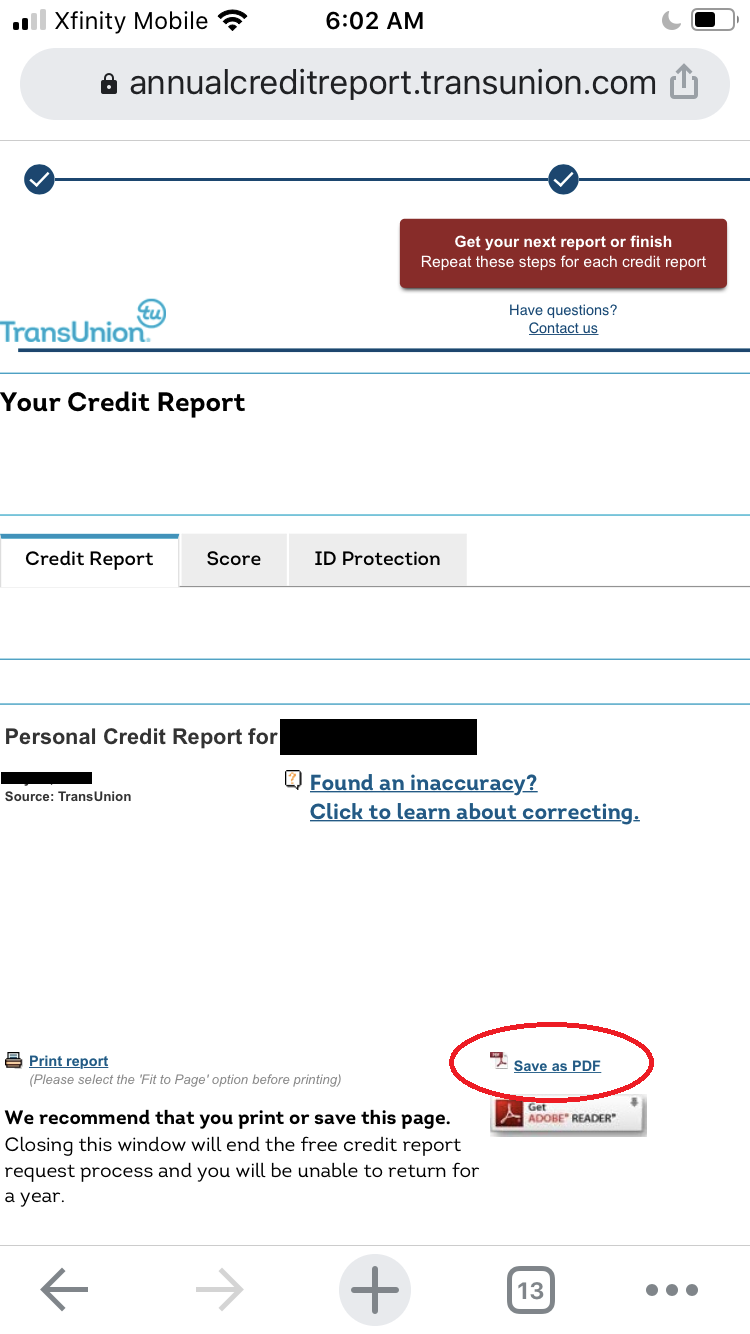

Download Your Report

Once verified, find the ‘Download Report’ option. Click it. Your report will download. Check it for errors.

Contact Transunion

If you spot errors, contact TransUnion. Use the ‘Dispute’ section on their site. This can improve your credit.

Navigating The Transunion Interface

Understanding your credit report is key to financial health. TransUnion makes this easy with a user-friendly interface. Let’s dive into the dashboard and report sections.

Dashboard Features

The TransUnion dashboard is your financial snapshot. It displays your credit score, credit factors, and recent alerts.

- Quick Score View: See your score at a glance.

- Alert Notifications: Stay updated on changes.

- Score Trending: Track your score over time.

Report Sections Explained

Your TransUnion report has several sections. Each part gives insight into your credit.

| Section | Description |

|---|---|

| Personal Info | Your name, address, and job. |

| Accounts | List of loans and credit cards. |

| Inquiries | Who checked your credit and when. |

| Public Records | Legal items like bankruptcies. |

| Collections | Unpaid debts sent to agencies. |

Each section impacts your credit score. Check them regularly for errors to keep your score healthy.

Downloading Your Report

Getting your TransUnion credit report is important. It shows your financial health. You can download it easily. Let’s see how.

File Formats Available

You can get your report in different formats. These include:

- PDF – Easy to read and save on all devices.

- HTML – Good for viewing online.

Saving Your Report Securely

Keep your report safe. Follow these tips:

- Save it in a secure folder on your computer.

- Use a password for extra safety.

- Make a backup copy. Store it in a different place.

Credit: macklawonline.com

Understanding Your Transunion Report

Getting a grip on your TransUnion credit report is crucial for financial health. A credit report paints a picture of your creditworthiness. It matters when applying for loans or credit cards. Let’s dive into the key aspects of your TransUnion report.

Key Components

Your TransUnion credit report includes several important sections:

- Personal Information: Your name, address, and employment data.

- Account Summaries: A list of credit accounts and their statuses.

- Inquiry Information: Records of who has accessed your report.

- Public Records: Court-related information, like bankruptcies.

- Credit Summary: A snapshot of your credit accounts and debts.

Interpreting Scores And History

Understanding your scores and history is key to managing credit. Here’s what to look for:

| Score Range | Meaning |

|---|---|

| 300 – 579 | Poor |

| 580 – 669 | Fair |

| 670 – 739 | Good |

| 740 – 799 | Very Good |

| 800+ | Exceptional |

Look at payment history and credit utilization to gauge standing. These factors influence your score the most. Keep tabs on them for a better score.

Troubleshooting Common Issues

Getting your TransUnion credit report should be easy. Sometimes, issues arise. This section helps solve common problems.

Login Problems

Can’t log in? You’re not alone. Many face this issue. Let’s fix it:

- Check your username and password. Are they correct?

- Reset your password if you forgot it. Use the “Forgot Password” link.

- Clear your browser cache. Sometimes, old data causes problems.

- Try a different browser. Some work better than others.

Error Messages During Download

Seeing error messages? They can stop your download. Here’s what to do:

- Read the message. It often tells you the problem.

- Check your internet. A stable connection is needed.

- Update your browser. An old version may not work well.

- Contact TransUnion support. They can offer specific help.

Remember, patience helps. Follow these steps for a smoother experience.

Protecting Your Personal Information

As you consider downloading your TransUnion credit report, safeguarding your personal data is crucial. In today’s digital age, data breaches are a real threat. It’s essential to understand how TransUnion keeps your information secure and the best practices you can follow to protect your privacy.

Data Security Measures

TransUnion implements robust security protocols to ensure your credit report remains safe. This includes multiple layers of security, such as:

- Encryption to scramble data, making it unreadable to unauthorized users.

- Secure connections that shield information as it travels across the internet.

- Authentication processes to verify your identity before granting access to your credit report.

These measures reduce the risk of unauthorized access and keep your personal data protected.

Best Practices For Privacy

While TransUnion takes steps to protect your credit report, there are actions you can take to maintain privacy:

- Use strong passwords and change them regularly.

- Enable two-factor authentication where available for an extra security layer.

- Monitor your accounts for any suspicious activity and report it promptly.

Following these best practices helps keep your personal information secure online.

Using Your Transunion Report

Understanding your TransUnion credit report is crucial for financial stability. This report holds your credit history. It shapes your financial opportunities. Knowing how to use this report can make a big difference.

Improving Credit Health

Credit health is like physical health. It requires regular check-ups and smart habits. Your TransUnion report is your financial check-up. It shows your credit score. It lists your debts and payment history. Use this info to improve your score. Pay bills on time. Keep debt low. These actions boost your credit health.

Addressing Discrepancies

Sometimes, reports have errors. These can hurt your credit score. Check your TransUnion report for mistakes. Look for debts you don’t recognize. Check personal details. Are they correct? If you find errors, report them to TransUnion. They must investigate. They’ll fix valid discrepancies. This keeps your credit report accurate.

Credit: www.transunion.com

Frequently Asked Questions

Can I Download My Transunion Credit Report Online?

Yes, you can download your TransUnion credit report online. Simply create or log into your account on the TransUnion website, navigate to the credit report section, and follow the instructions to view and download your report. It’s quick, easy, and accessible anytime.

How Often Can I Download My Credit Report For Free?

You’re entitled to one free credit report from each of the three major credit bureaus, including TransUnion, every 12 months. To get your free report, visit AnnualCreditReport. com. Outside of this, you may have to pay or sign up for monitoring services for more frequent access.

What Information Do I Need To Download My Transunion Report?

To download your TransUnion credit report, you’ll need to provide some personal information for verification. This includes your full name, address, Social Security number, and date of birth. You may also be asked to answer security questions based on your credit history.

Is Downloading My Transunion Credit Report Safe?

Yes, downloading your TransUnion credit report from the official website or a trusted partner is safe. Ensure you’re on a secure connection (look for “https” in the URL) and avoid public Wi-Fi networks to protect your personal information.

Conclusion

Understanding your TransUnion credit report is key to managing your financial health. You now know downloading it is simple and beneficial. Regular checks on your credit report help keep your finances in check. They also protect against identity theft. Make it a habit to review your credit report often.

This small step can lead to better credit opportunities. Remember, staying informed is your right and a smart financial move. Start today, and keep your credit score on the right track.